Crypto venture company represents an innovative approach to the investment landscape, merging the world of cryptocurrency with traditional venture capital strategies. As these companies gain momentum, they pave the way for groundbreaking projects and technologies, transforming how we perceive and engage with digital assets.

The evolution of crypto venture companies over the past decade has been remarkable, marked by notable success stories that highlight their impact on the industry. From funding blockchain start-ups to developing sustainable investment practices, these firms are at the forefront of a financial revolution.

Overview of Crypto Venture Companies

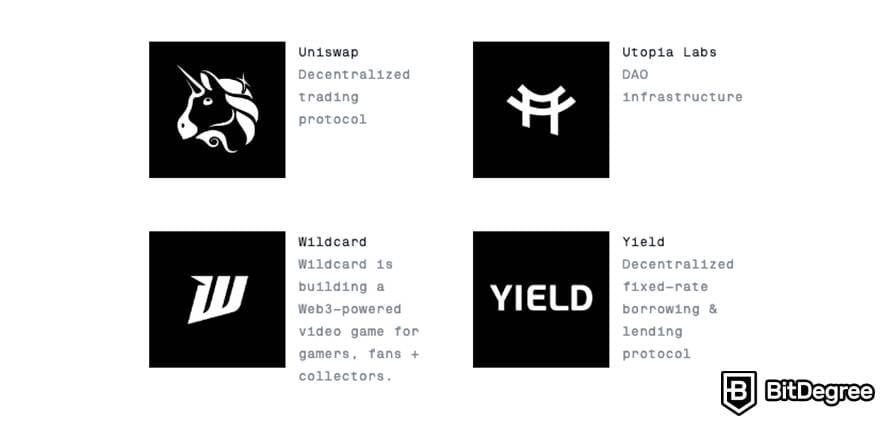

Crypto venture companies represent a new breed of investment firms that specifically focus on funding and supporting startups operating within the blockchain and cryptocurrency space. These companies often provide not just capital but also strategic guidance, networking opportunities, and resources to help emerging projects scale and succeed. Over the past decade, we’ve witnessed significant growth in this sector, with crypto venture firms becoming crucial players in the broader tech ecosystem.Notable examples of successful crypto venture companies include Andreessen Horowitz (a16z), Pantera Capital, and Digital Currency Group.

These firms have significantly impacted the industry by funding groundbreaking projects such as Coinbase, Chainalysis, and Blockstream, driving innovation and adoption of cryptocurrencies and blockchain technology. The evolution of these firms has been marked by a shift from early speculative investments to more strategic partnerships, emphasizing long-term sustainability and growth.

Business Model and Structure

The typical business model of a crypto venture company revolves around raising funds from investors to deploy into promising startups within the cryptocurrency sector. These firms often operate on a limited partnership structure, where investors commit capital for a defined period, and the venture firm manages these investments with the goal of achieving high returns.The organizational structure of crypto venture companies tends to be relatively flat, promoting agility and quick decision-making.

Key roles within these firms include:

- General Partners: They are responsible for fundraising, investment decisions, and overall strategic direction.

- Analysts: Analysts conduct market research, assess potential investment opportunities, and provide data-driven insights to support decision-making.

- Portfolio Managers: These individuals manage the investments and are involved in the growth and development of portfolio companies.

- Legal and Compliance Teams: They ensure that all investments comply with applicable regulations and legal frameworks.

Investment Strategies in Crypto Ventures

Crypto venture companies employ various investment strategies that cater specifically to the unique dynamics of the cryptocurrency market. Some common strategies include early-stage funding, token investments, and strategic partnerships with blockchain projects.A comparison between traditional investment strategies and those unique to the crypto space reveals several differences:

- In traditional ventures, investments are often made in established companies with proven business models, whereas crypto ventures frequently invest in nascent projects with untested ideas.

- Traditional investors may focus on equity stakes, while crypto ventures often acquire tokens or coins that give access to a platform’s services or profits.

- Risk management in crypto ventures involves active portfolio management, due diligence on blockchain teams, and market trend analysis to mitigate the high volatility associated with cryptocurrencies.

Regulatory Environment

The regulatory landscape affecting crypto venture companies is complex and continually evolving. Different jurisdictions have approached cryptocurrency regulations with varying degrees of openness and restriction, creating challenges for venture firms operating globally.Challenges faced by these companies include compliance with anti-money laundering (AML) and know your customer (KYC) regulations, which can vary significantly from one country to another. Moreover, the lack of a consistent regulatory framework can lead to uncertainty and potential legal risks.

For example, while countries like Singapore and Switzerland have established clear guidelines that promote blockchain innovation, others, such as China, have imposed strict bans on cryptocurrency trading and fundraising activities.

Trends and Innovations

Current trends shaping the future of crypto venture companies include the rise of decentralized finance (DeFi), non-fungible tokens (NFTs), and the increasing integration of blockchain technology in traditional industries. These innovations are driving new investment opportunities and transforming the landscape of venture capital.Innovative technologies being adopted by crypto venture firms include artificial intelligence for market analysis, blockchain for transparent reporting, and smart contracts for automated investment processes.

Social responsibility and sustainability also play a growing role in investment decisions, with many firms prioritizing projects that focus on environmentally sustainable practices, such as energy-efficient blockchain solutions.

Case Studies

Notable crypto venture companies have launched flagship projects that serve as case studies for success in this rapidly evolving space. For instance, Andreessen Horowitz’s investment in Coinbase helped propel the platform to become one of the most prominent cryptocurrency exchanges in the world. The successful outcome of this investment demonstrates the potential for substantial returns in the crypto venture landscape.Conversely, lessons learned from failed crypto ventures, such as Bitconnect, highlight the importance of thorough due diligence and the risks associated with speculative investments in unregulated markets.

These case studies illustrate the need for a balanced approach to investing, where both potential rewards and risks are carefully evaluated.

Future Prospects

Looking ahead, potential developments in the crypto venture ecosystem are expected to include greater institutional involvement, advancements in regulatory clarity, and the emergence of new market segments. Predictions suggest that crypto venture companies will see significant growth in emerging markets, where blockchain technology can address various economic challenges.Insights from industry experts indicate that as the crypto market matures, the long-term viability of crypto ventures will depend on their ability to adapt to changing market conditions and regulatory frameworks, while continuing to drive innovation and value creation within the space.

Epilogue

In summary, the journey of crypto venture companies is just beginning, with exciting prospects ahead. As they navigate regulatory challenges and embrace innovative technologies, the potential for growth remains vast, promising a dynamic future for investors and entrepreneurs alike.

Expert Answers

What is a crypto venture company?

A crypto venture company invests in blockchain and cryptocurrency projects, combining traditional venture capital practices with digital asset strategies.

How do crypto venture companies make money?

These companies typically earn returns through equity stakes in start-ups, token sales, and successful exits from their investments.

What are the risks associated with investing in crypto ventures?

Risks include high volatility in the crypto market, regulatory changes, and the potential failure of start-ups due to the nascent nature of the industry.

How do regulatory environments affect crypto venture companies?

Regulations can impact investment strategies, compliance costs, and the viability of projects, often varying significantly by jurisdiction.

What trends are currently shaping crypto venture companies?

Current trends include increased sustainability efforts, the integration of DeFi (decentralized finance), and a focus on social responsibility in investment decisions.

![TOP-Ranked Cryptocurrency Companies [List] - Outsource IT Today TOP-Ranked Cryptocurrency Companies [List] - Outsource IT Today](https://healthylunchboxideas.com/wp-content/uploads/2025/09/crypto-Binance-trading-app.jpg)